Advanced AI in Finance Program

The Program is noteworthy for its flexibility and the quality of its advanced reference material.

Contact us to explore if the Program is suitable for your company.

Program offerings

The Advanced AI in Finance Program delivers, free of charge to participants, the following:|

|

ARPM Lab: online access to constantly updated advanced reference material on advanced Data Science and Quantitative Finance: theory, code, animations and more. |

|

|

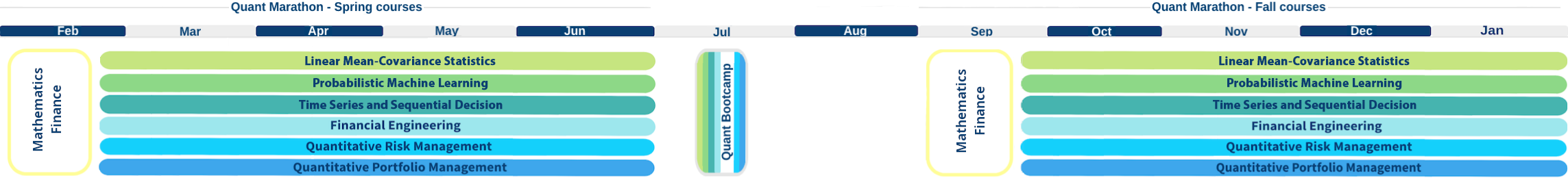

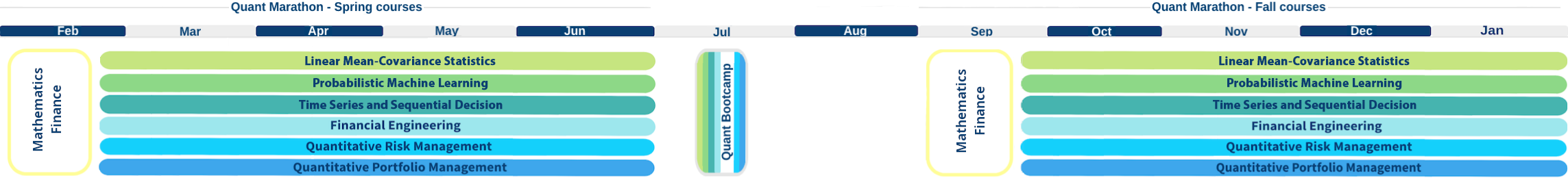

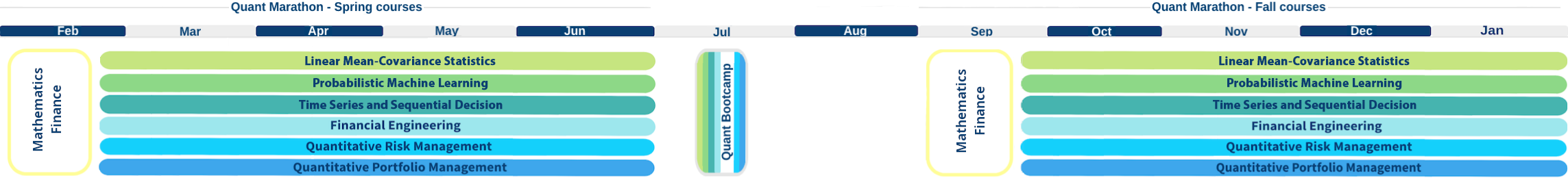

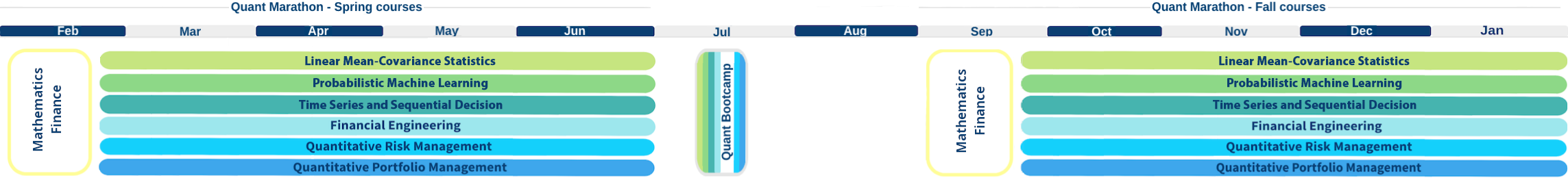

Quant Marathon:

6 in-depth courses to choose

from on advanced Data Science and

Quantitative Finance, based on the

Lab.

The next edition starts

September 23, 2024

. All participants are welcome to attend any parts of any course with colleagues and other participants in Class mode, or to follow on their own in Self-paced mode |

|

|

Quant Bootcamp:

4+2 days overview course in

advanced Data Science and

Quantitative Finance, based on the

Lab. The next edition is

starting on July 8, 2024.

All participants are welcome to attend any parts or the Live Streaming version, and up to 6 participants per edition are welcome to the Onsite event in New York. The recordings can also be followed in self-paced mode. |

| Workshops: 90-min working sessions, delivered quarterly, customized to the practical/theoretical needs of each specific company. |

Schedule of courses

Audience

The Program caters to two different types of employees- “Quants”, defined as employees with a STEM-MA

- “SuperQuants”, defined as employees with a STEM PhD

Delivery options

First and foremost, each participant has access at all times to the Lab, the go-to look-up reference for their quantitative work, similar to a subscription to a state-of-the-art 24hr gym.

Furthermore, each participant can cover the contents of the Lab on a personalized plan in self-paced mode, tailored to their individual interests, time availability and background. Our engine re-optimizes each participant's plan weekly based on actual progress.

Additionally, participants may also choose to learn in classes, with a live instructor and other participants

- (any portions of) the Live Streaming/Onsite Quant Bootcamp, for a quick, intense overview (suitable for all backgrounds)

- (any portions of) the any course of the Quant Marathon, for in-depth learning (suitable for Quants and SuperQuants)

Typically each individual participant alternates between long periods in self-paced mode and short periods in classes.

Benefits

- Knowledge/skills: participants reach beyond master-level knowledge and skills across all parts of Data Science and Quantitative Finance, and stay up to date on how the latest techniques connect to best practices

- Networking: participants learn and practice side by side with Quants and SuperQuants from the top financial companies worldwide

- Statements of completion: regardless of whether learning the Lab in self-paced mode or in class training, upon reaching a satisfactory score by a combination of independent study in the Lab, quizzes, homework, etc., participants are issued up to 7 different statements of completion

- Lifetime Lab: participants are welcome to take the three exams of the ARPM Certification , which grants permanent Alumni benefits, including lifetime access to the Lab.

Frequently Asked Questions

What is special about the Program?

The Program is unique for

- the Lab: the most complete online study/practice materials for advanced Data Science and Quantitative Finance

- the flexibility: no matter the time availability, every participants has the opportunity to learn

Who should join the Program?

All employees should join the Program and gain immediate access to the ARPM Lab.

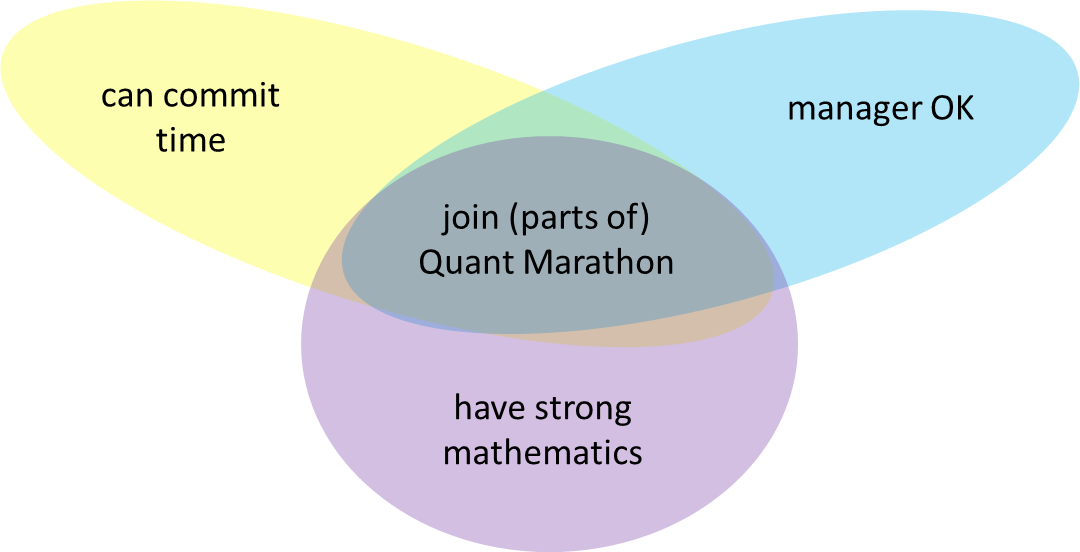

Then, each quarter, each employe evaluates whether

-

(s)he can attend (parts of) the Quant Bootcamp

-

(s)he can attend (parts of) the Quant Marathon

The website prompts for a payment, why?

No payment is due.

For immediate access to the Program, create your free account by following “Go to your company's

registration page” at the top of this page.

The website says “private content”, why?

For immediate access to the Lab, create your free account by following “Go to your company's registration page” at the top of this page.

How do I join the Quant Bootcamp/Quant Marathon?

We will place you there when the respective courses are about to start.

Is the Quant Marathon in Class mode?

Yes. The Class mode requires a commitment of ~4 hours/week for 5 months, but you can switch to Self-paced mode anytime.

When are the Quant Marathon live classrooms?

To see the detailed schedule, create your free account by following “Go to your company's registration page” at the top of this page.

Also, see the FAQs about the Quant Bootcamp, the Quant Marathon, the ARPM Certification.