What will you learn?

Quant Marathon

Beyond-master program online in

advanced Data Science and

Quantitative Finance

| Classes | September 23, 2024 |

|---|---|

| Self-paced | any time |

The Quant Marathon is a beyond-master level online program in data science and quantitative finance.

The Quant Marathon comprises Core courses and Primers . You can follow the whole program or individual courses, which can be purchased and followed separately or purchased in bundle and followed simultaneously or in sequence.

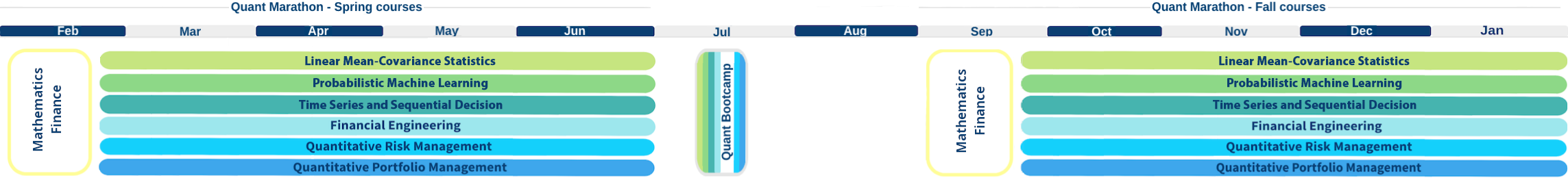

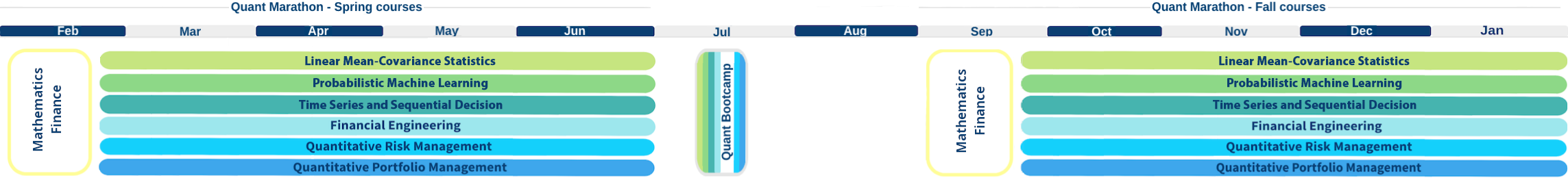

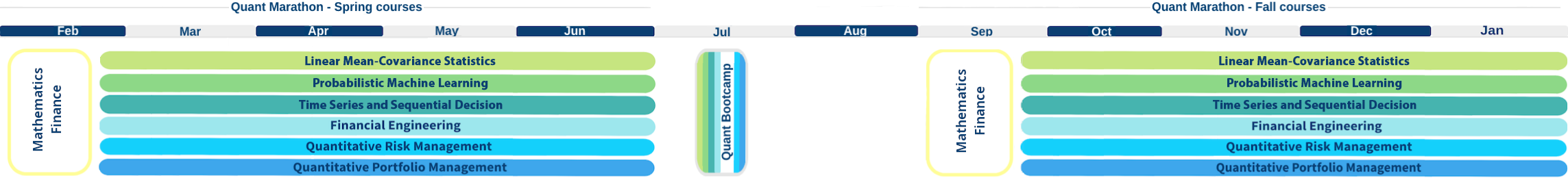

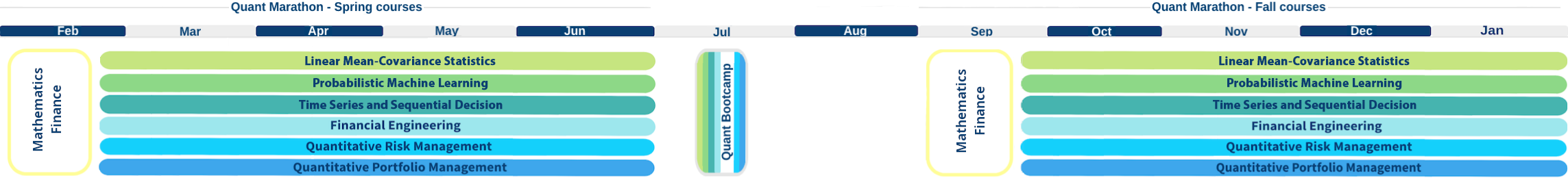

Schedule

Delivery options

All core courses are delivered online in two modes:

- Class: participants follow with other Marathoners, led by ARPM instructors (schedule above)

- Self-paced: participants follow independently, plan reoptimized weekly

|

|

|

|

|---|---|---|

| Next start | September 23, 2024 | Anytime |

| Average commitment | 4 hours/week | re-optimized weekly |

| Live instructors | yes | no |

| Duration | 6 months | any |

Each participant customizes his/her path by

- Selecting individual course(s) and their sequence

- Switching during any course to and from Class and Self-paced mode

See what our alumni say

Read moreThe Quant Marathon has thousands of Alumni from around the world, including industry leaders and academics.

Our alumni hold key positions at leading organizations across the world, including Bank of America, Barclays, Merrill Lynch, J.P. Morgan, HSBC, Deutsche Bank, Bank of China and Bloomberg.